Note: Click here to go to my Github Repository

Note: Click here to go to my Personal Website

Objective:

- In this project we study and compare the asset allocation methodology followed through mean variance portfolio optimization (MVO) and Sharpe Ratio optimization by using the PyPortfolioOpt library in python

Methodology:

- Performed stock selection by choosing eight stocks which span across five industries and have a dispersed range of correlations. Downloaded the stock prices from yfinance library in python.

- Analysed the stock prices, returns and correlations.

- Formulated the objective and constraints for mean variance optimisation and solved it using PyPortfolioOpt. Analysed the bias in the results towards high return stocks.

- Performed sharpe ratio optimization by finding the optimal risk aversion factor in order to get the maximum sharpe portfolio weights.

- Then validated the same results as above by using PyPortfolioOpt’s max_sharpe function

- Changed the constrains of the portfolio, to allow short selling. Optimized it to realise better sharpe ratio portfolio.

- Changed the sector constraints of the portfolio, by restricting the weights on tech stocks. This provided better diversification but resulted in a reduction in sharpe ratio.

Conclusion:

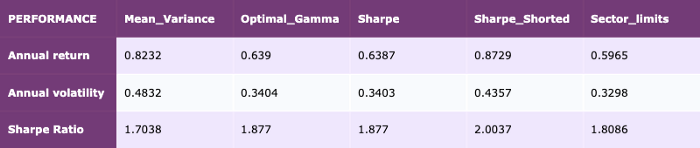

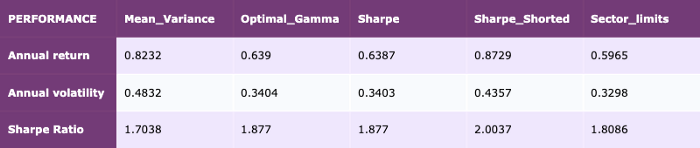

- We compared the performance of various optimization methods like the traditional mean variance optimization, sharpe ratio optimization and also explored different ways to further enhance the model performance.

- Based on the current analysis, we conclude that the sharpe ratio maximization portfolio with short selling allowed is the most optimal portfolio with sharpe ~2.0 and returns ~87%.

Objective

- Objective of the project was to build a bitcoin price prediction model.

Data Collection

Objective of sub project:

- In this project I am trying to scrape the Bitcoin.com website and downlaod various paramters belonging to the Bitcoin cryptocurrency. I am going to use this data in a bitcoin price prediction project later.

Model Development

Model Setup

- As this is the sequence model. I assumed the past 28 days of data would be affecting next 7 days of data. So the input for the model will be 28 days data and the output would be the next 7 days.

Simple Neural Network

- Even though this is a sequential model , just to test , I started off with a simple 2 dense later NN where I flattened the data to get the vectorised outputs.

RNN model with LSTM layer vs GRU Layer

- Then I moved on to implement a simple RNN with a LSTM hidden layer and a GRU hidden layer. We found that GRU was giving a better

RNN model with GRU layer and recurrent dropout

- Then we added a recurrent dropout which further improved the model . I also used a early stopping condition which stopped the model from overfitting to the data.

Model Evaluation

- I evaluated the models based on the Mean absolute error and RMSE

- Finally to find the accuracy of our model, considering the fact that bitcoin is very volatile, I took a range of 1% around the bitcoin price and saw in how many days our prediction was inside that range. This turned out to be around 90% accurate

Objective:

- The Project aims to design the optimal monthly roll strategy for SPX futures such that we have minimum roll cost.

Project 4: Implementing Machine Learning algorithms from scratch::

Objective:

- The objective is to better understand the maths behind OLS and implement it in the Gradient Descent approach by using just numpy.

Objective:

- The objective is to better understand the maths behind Logistic regression and implement it in the Gradient Descent approach by using just numpy.

Objective:

- In this project we will be solving KNN Regression problem from scratch. We will be implementing the KNN problem in the naive method using a for loop and also in a vectorised approach using numpy broadcasting. We will also plot the root mean squared error for various K values and chose the optimal number of nearest neighbours.